Indian stocks Markets await the announcement of many Q4 outcomes for the companies starting from April 1.

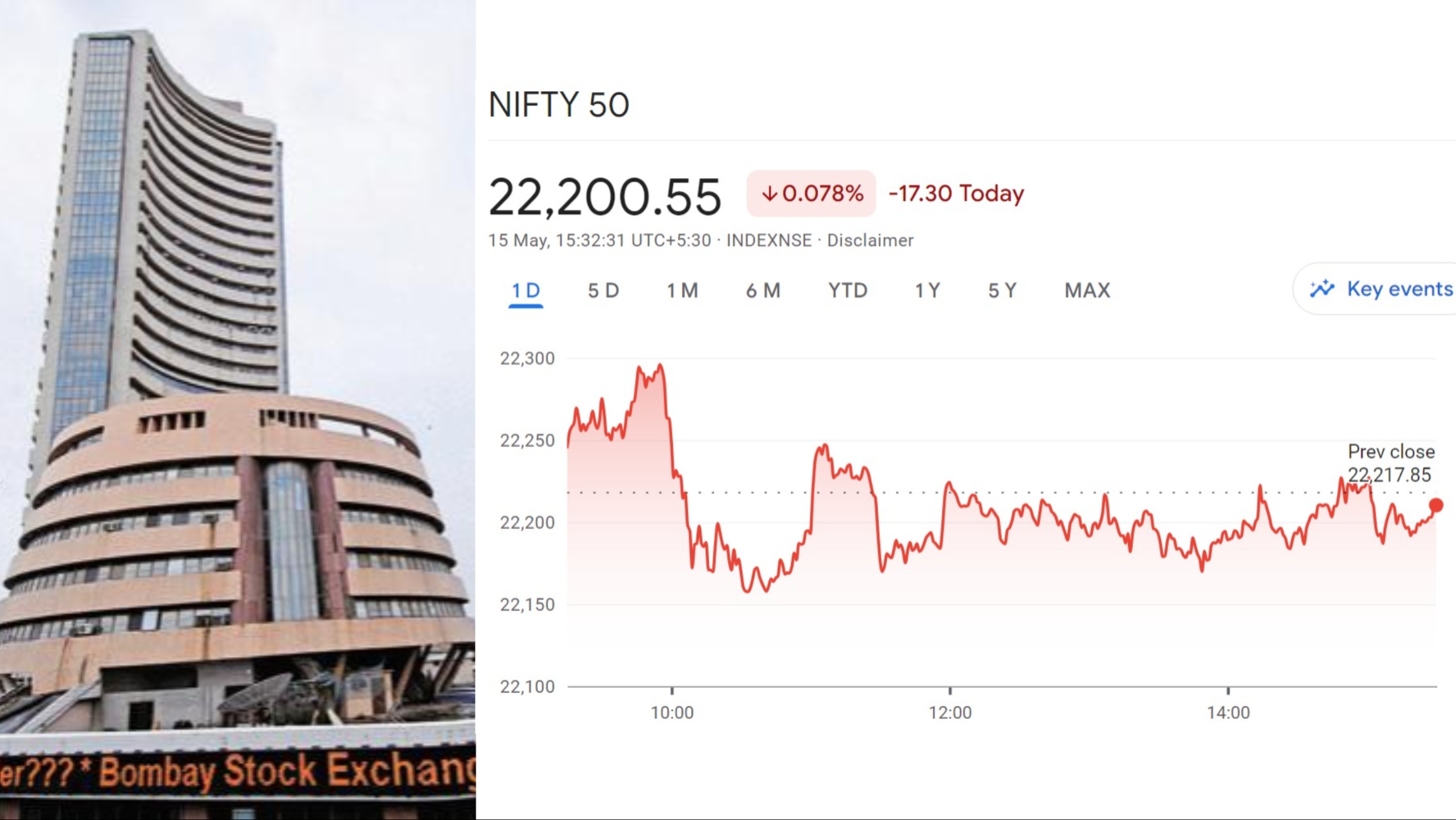

As the sturdy Indian benchmark indices continued exhibiting a moderate yet steady staying power, posting yet more upticks on that momentous Thursday of May 16, 2024, the ever-watchful market continues finding ever more exciting developments across its multitude of sectors. With a veritable fleet of companies now making preparations for their impending Q4 results, investor attention likewise turns its focus to such crucial developmental giants as the multisectoral behemoth Vedanta, the steadfast financial institution Shriram Finance, the ubiquitous motorised transport provider Hero MotoCorp, and the expansive real estate enterprise DLF, among others. Here now are those most meaningful market-shaping updates in a concise yet salient summary.

Q4 Results Anticipation

Today was a pivotal moment in the financial quarter as many respected corporations are scheduled to uncover their results for the past three months. Among the major names expected to yield their numbers are Bharti Airtel, the technology giant Siemens, cement extraordinaire Shree Cements, oral care stalwart Colgate-Palmolive, real estate developer Oberoi Realty, and staple consumer goods provider Patanjali Foods. Investors and analysts eagerly await to analyse how these prominent fixtures have fared financially in recent times and gain foresight into the ever-fluctuating commercial environment.

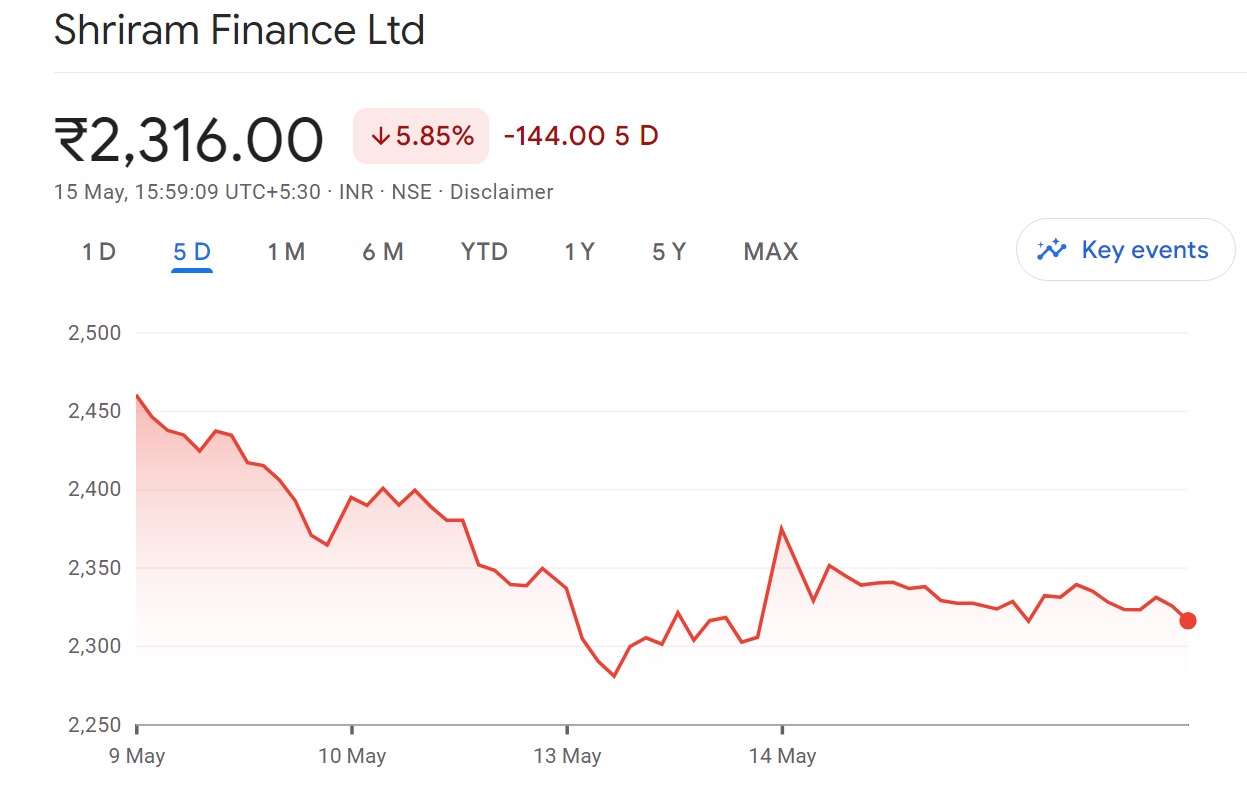

Shriram Finance’s Strategic Move

In a move sure to streamline operations and unlock value, lending leader Shriram Finance greenlit the Rs 4,630-crore disposal of housing subsidiary Shriram Housing Finance to global investment goliath Warburg Pincus. This sharp strategic shift sees the shadow bank shed one segment to focus firepower elsewhere while pocketing a pretty penny; the transaction similarly plays to Warburg’s persisting pursuit of prospects in India’s flourishing but fractious financial sphere. Such significant sell-offs and acquisitions signify shifting strategies and the continual recalibration of long-term visions as a firm’s perturbation persists amidst an unpredictable environment.

Hero MotoCorp Joins ONDC Network

In a development that underscores the company’s dedication to embracing digital innovation and revolutionising how customers can access two-wheeler parts and accessories, prominent Indian automobile manufacturer Hero MotoCorp has become the first company in the auto sector to participate in the ONDC initiative. The Open Network for Digital Commerce aims to transform e-commerce across India by promoting interoperability between platforms and broadening inclusion. Hero MotoCorp’s pioneering involvement underscores its commitment to these goals by fostering greater accessibility and convenience for customers in their acquisition of two-wheeler components and add-ons.

Vedanta Considers Financial Options

The metal and mining conglomerate Vedanta has begun weighing strategies for raising capital. One avenue under deliberation is a stock offering or convertible securities issuance to bolster finances. This preemptive action by Vedanta exemplifies proactive financial management and an aim to reinforce an already solid footing. Market players will keenly watch the results of Vedanta’s musings on this matter, anticipating clues about how this move could affect the company’s developmental curve going forward.

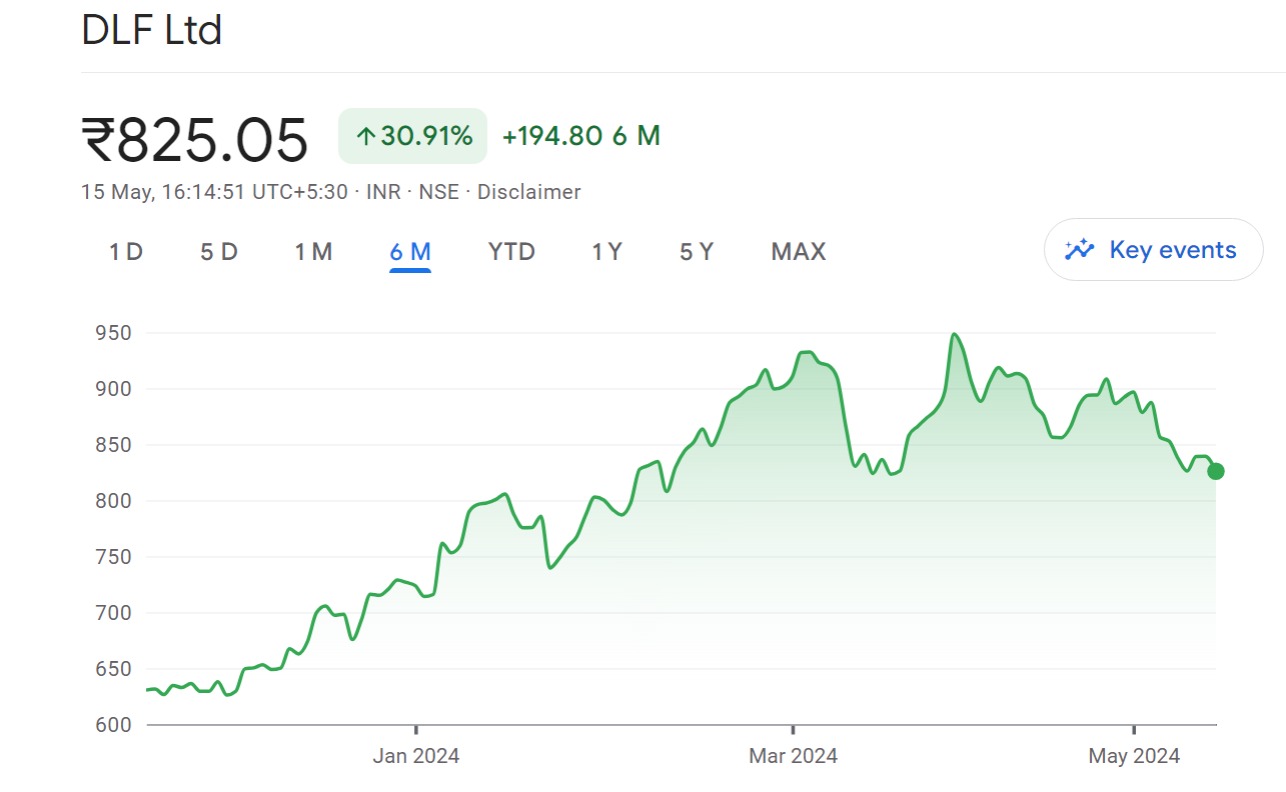

Impressive Performance by DLF

DLF, a prominent force in the real estate sphere for decades, has proclaimed an impressive 61.5 per cent yearly boost in total net earnings for the last quarter concluding March fiscal year 2024. Empowered by robust growth at the top and bottom lines as well as nimble administration, DLF’s combined net profit arrived at a mighty Rs 920.7 crore. The company’s powerful presentation underscores its enduring strength even as the property sector weathers changing trends. At the same time, costs tied to new developments have ballooned substantially because of inflationary pressures and global supply chain complications. However, DLF’s diversified portfolio of holdings and emphasis on lucrative segments have helped shelter it from significant sinking pressures. Moving ahead, strategically timed fresh introductions and maintaining strong sales momentum will be pivotal to ride out unpredictable markets.

Jindal Steel and Power Demonstrates its Strength

While Jindal Steel & Power confronted difficulties, including decreased income from their activities, they exhibited resilience by declaring a merged net benefit of Rs 933.5 crore for the March 2024 quarter. With a 100.5 for every penny yearly bounce, JSPL’s benefit mirrors their proficient cost administration procedures and operational greatness regardless of a serious scene. In any case, their achievement was not without its tests as lower incomes from tasks represented a test. In this way, their vital administration of expenses and centre around task quality were key components supporting their productivity. Moving ahead, keeping up this equilibrium between cost control and operational productivity will be basic to support benefits against contending energies in their business.

As the Indian market proceeds through vibrant changes and emerging patterns, the focus stays on corporations making calculated actions and exhibiting sturdy output. With the expectation surrounding the fourth quarter’s results and noteworthy evolutions across industries such as finance, vehicle manufacturing, metals, and real estate, financiers are poised for an eventful trading session containing many surprises. The effects of these evolutions are probable to mould sentiment in the marketplace and deliver important comprehension into the pathway of individual businesses and the overall economic system. Some companies may report sizes of profit that astound analysts, while others disclose unforeseen losses that rouse debates around administration choices and strategic vision. A few sectors could indicate robust growth ahead, whereas certain others struggle with unique challenges introduced by worldwide influences. Through it all, decision-makers stay dedicated to adjusting to disruption and capitalising on emerging possibilities.