Shriram Finance advised multiple stock trades that it had sold its full stake in its subsidiary.

Shriram Housing Finance. Following this announcement, shares jumped over 5% during Tuesday’s exchange. This crossroads mirrors a critical change in Shriram Finance’s strategic vision. The worldwide private value firm Warburg Pincus put resources into obtaining SHFL in an offer esteemed at Rs 4,630 crore, demonstrating the more significant pattern of resource reworking in the Indian monetary administration area.

The exchange permits Shriram Finance to return to its centre business while giving its new financial specialist control of SHFL to grow its operations and seek new open doors sufficiently supported by capital. Meanwhile, SHFL’s new financial backer gets a set-up business at an alluring valuation and has the opportunity to take it to newer statures.

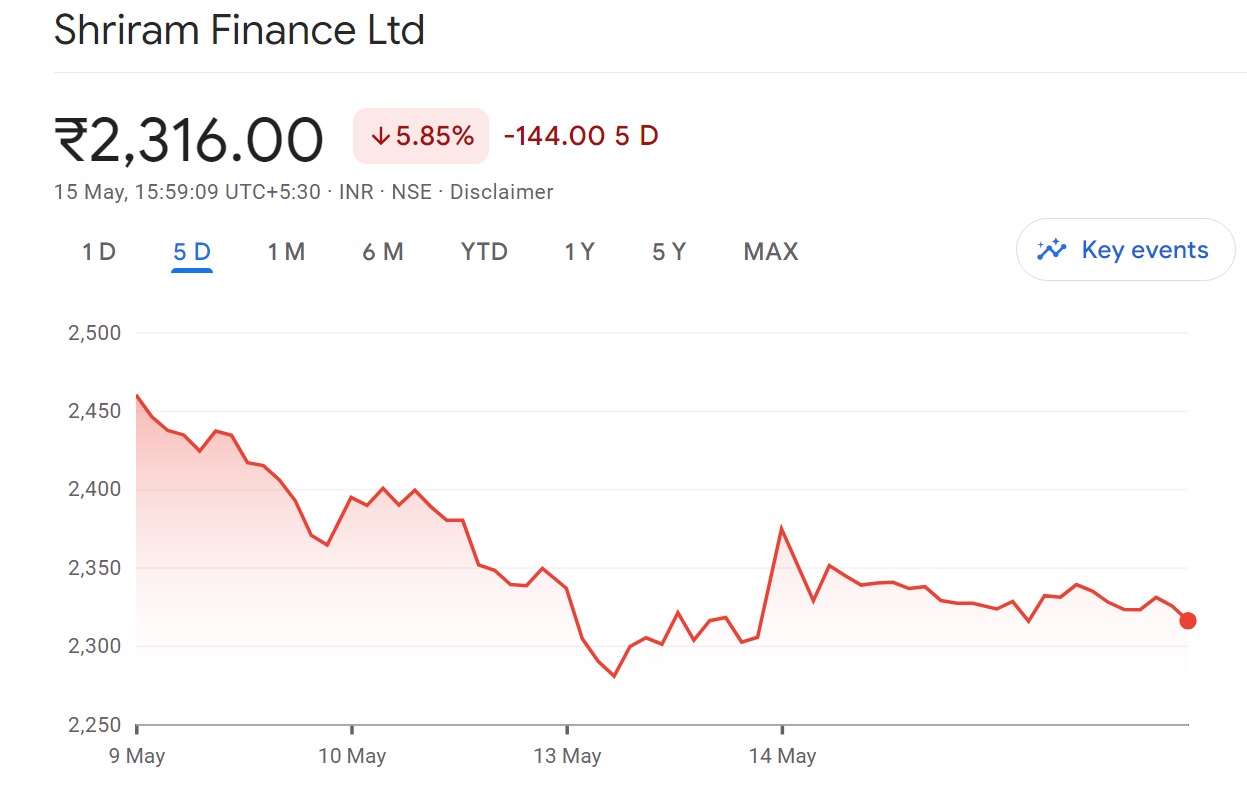

Surge in Shares Amid Strategic Decision Announcement

Shares of Shriram Finance Ltd saw a notable rallying of over 5.17 per cent during trading on Tuesday, driven by the corporation’s statement regarding a sizable strategic choice. In an effort to maximise functioning and strengthen shareholder worth, Shriram Finance opted to sell off its full participation in Shriram Housing Finance Ltd. This principal shift in corporate strategy underscores the business’s goal to streamline its portfolio and concentrate on core expertise, bringing pleasant returns for investors on the back of a clearer strategic path and priorities. Meanwhile, the divestment will allow housing finance to operate with full autonomy as a standalone entity pursuing new growth avenues while freeing up capital for the parent to deploy elsewhere. Investors welcomed the news, expecting the strategic reset would enhance long-term competitiveness through tighter focus despite some short-term loss of revenue from the housing subsidiary.

Warburg Pincus: A Strategic Buyer

The sizable holding in SHFL, valued at approximately Rs 4,630 crore, will be procured by the global investment firm Warburg Pincus, operating through their company Mango Crest Investment. This permits Warburg Pincus to exploit opportunities within the progressively expanding housing market through strategic planning. Furthermore, it has expanded its presence in India’s financial industry, where its expertise can be employed to assist more consumers in obtaining housing. Undoubtedly, this calculated manoeuvre will advantage both SHFL and Warburg Pincus in the long term by maximising each other’s strengths for common accomplishment within this critical part of the Indian economy. However, some concerns remain regarding how sustained growth can be achieved harmoniously without overheating parts of the market in the short run. While the acquisition opens opportunities, careful management will be necessary to balance interests equitably over the long term.

Financial Implications and Market Response

The proposed merger between the two financial giants is anticipated to yield abundant gains for all parties involved. Shriram Finance stands poised to receive a sizable infusion of nearly four thousand crores from divesting a portion of its equity, providing a tremendous boost to its balance sheet. Additional payouts tied to contractual triggers further sweeten the deal. This fresh capital is forecasted to substantially reinforce the company’s financial footing and endow leadership with augmented flexibility to pursue its ambitious growth blueprint aggressively.

Initial analyst reaction to the bombshell announcement has proven overwhelmingly optimistic, with many viewing the negotiated sale price as fairly valued given current economic headwinds. Despite the per-share amount landing slightly below earlier estimates, shareholders displayed confidence by propelling Shriram Finance’s stock price north of two thousand four hundred rupees and swelling its total market value past the ninety thousand crore mark.

Kotak Institutional Equities’ Analysis

Kotak Institutional Equities, a prominent financial services consultancy, provided nuanced insights into the transaction’s ramifications for Shriram Finance’s fiscal performance. According to Kotak’s research, selling the housing loan subsidiary is estimated to bolster Shriram Finance’s net worth by 4% for the fiscal year 2024, as the deal values the unit at 2.4 times its book value.

While some worry about Shriram Finance’s return on equity relative to competitors, Kotak remains bullish on the core business’ promising growth, especially the impressive 71% surge in assets under management. As proof of their conviction, Kotak Institutional Equities reaffirmed a “buy” recommendation on Shriram Finance stock, setting a fair value of Rs 3,000.

Strategic Realignment and Future Outlook

The divestment of Shriram Housing Finance allows the company to optimise efforts by concentrating core functions. This transaction, projected to strengthen the balance sheet and reward investors, positions Shriram Finance for continued progress and prosperity during dynamic disruption.

As a new phase begins, Shriram Finance stays true to beneficiaries while grasping emerging potential. With astute foresight and emphasis on progress and productivity, Shriram Finance is equipped to handle hurdles and leverage prospects on the horizon. From streamlining to investment to innovation, Shriram Finance navigates fluctuation focused on long-term service and success.

As Shriram Finance embarks upon this new journey, the company is well-positioned for ongoing expansion and accomplishment. By streamlining procedures and concentrating on core undertakings, Shriram Finance intends to unlock investors’ worth and take advantage of rising possibilities. With the backing of strategic allies like Warburg Pincus and confirmation from market experts similar to Kotak Institutional Equities, Shriram Finance stays committed to providing lasting value and promoting invention in the continuously transforming financial industry. Moreover, although obstacles may emerge along the way, Shriram Finance has demonstrated resilience and good governance, serving it well for future obstacles as it pursues its mission of empowering Indians through inclusive and sustainable growth.